New Guidance for Making Tax Digital for VAT

HMRC have now issued their detailed guidance on Making Tax Digital (MTD) for VAT regarding digital record keeping and return requirements. It has been clarified that business records can still be kept with the use of spreadsheets if there is bridging software that links to the Government gateway.

There will also be a one year “grace” period during the first year of MTD when businesses will not be required to have digital links between software programs, referred to in the VAT Notice as a “soft landing”.

The VAT notice includes several helpful examples illustrating different accounting systems and the digital links required to comply with MTD for VAT so no matter how you keep your records currently, there should be an appropriate solution for you.

When Does MTD for VAT Start?

The Making Tax Digital rules apply from your first VAT period starting on or after 1 April 2019. A ‘VAT period’ is the inclusive dates covered by your VAT Return.

For example, where a business submits quarterly returns covering the periods to 28 February, 31 May, 31 August and 30 November, the business will need to comply with Making Tax Digital rules for the VAT quarter starting 1 June 2019 and ending on 31 August.

“Soft Landing” for MTD for VAT for the First Year

Businesses will not be required to have digital links between software programs for the first year of MTD for VAT (VAT periods commencing between 1 April 2019 and 31 March 2020). The only exception to this is where data is transferred to another product (such as a bridging software) which is API enabled for the purpose of submitting the 9 Box VAT Return data to HMRC. The transfer of data to this product must be digital.

For the first year of MTD for VAT (VAT periods commencing between 1 April 2019 and 31 March 2020), where a digital link has not been established between software programs, HMRC will accept the use of cut and paste as being a digital link for these VAT periods.

However, for VAT periods starting on or after 1 April 2020, there must be a digital link for any transfer or exchange of data between software programs, products or applications used as functional compatible software.

Using Spreadsheets

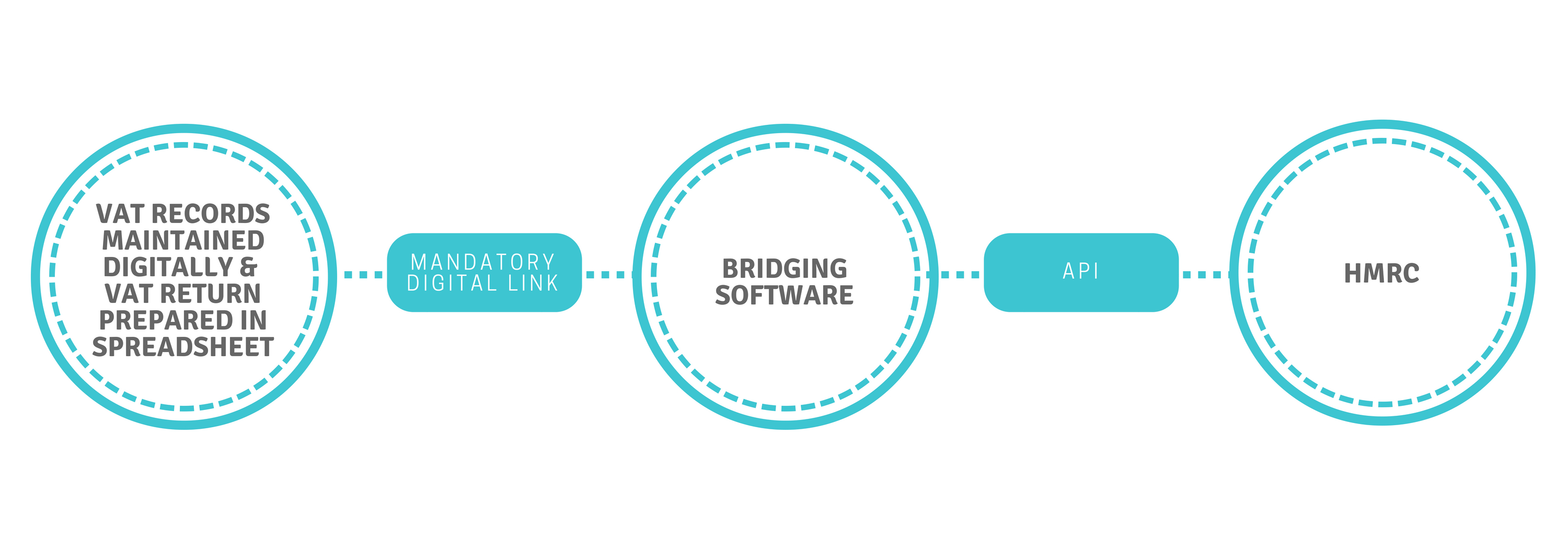

Example 3 in the VAT Notice describes a business that uses a spreadsheet and bridging software from April 2019, which allows the information to be transferred to HMRC via an API. All sales, purchases and expenses are recorded using a spreadsheet. Then within the spreadsheet the VAT Return is prepared, using formulae already written in.

The VAT Return information is then sent via a mandatory digital link to bridging software. This then digitally submits the information directly to HMRC.

If you would like further information on how MTD may affect your business or need any further guidance, then please contact us for more details.